carried interest tax proposal

Some view this tax preference as. Web Changes to the tax treatment of carried interest are proposed in the new rebranded budget reconciliation legislation that Democratic senators publicized on July 27.

Carried Interest Tax To Carry Water For Reform

Web Carried interest offers lower tax rate than for income Biden administration had proposed eliminating the tax break House Democrats Tax Plan Includes 265 Top Corporate Rate.

. The carried interest provisions described below were removed from the legislation during Senate consideration of the reconciliation bill and were not. Web November 1 2021. Web Several lawmakers have also introduced the Carried Interest Fairness Act which would tax carried interest at ordinary income tax rates and treat it as wages subject to employment.

Web Tax concession rate The Proposal provides that eligible carried interest would be charged at a 0 profits tax rate such rate was kept silent under the Consultation Paper. Web The private equity industry has defended the tax treatment of carried interest arguing that it creates incentives for entrepreneurship healthy risk-taking and investment. Web The Biden administration fact sheet misleadingly implies that a carried interest tax would only hit hedge funds while other proponents of the tax hike portray carried interest as a.

Taxpayers should be aware that they may soon lose the advantage of long-term capital. House Ways and Means Committee Chairman Richard Neal on Monday proposed a major set of tax hikes to fund Democratic President Joe. Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and.

Web On August 5 2021 Senate Finance Committee Chairman Ron Wyden and Senator Sheldon Whitehouse introduced proposed legislation the Ending the Carried Interest Loophole. Web The private equity industry has defended the tax treatment of carried interest arguing that it creates incentives for entrepreneurship healthy risk-taking and investment. While the Stop Wall Street Looting Act a comprehensive bill first introduced in 2019 never made it.

Web 14 Sep 2021 0. The latest effort to narrow the preferential tax treatment used by private equity executives failed after Senator. Web Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

Web The Carried Interest Loophole Survives Another Political Battle. Web Proposed end of carried interest would mean tax hike for rich Wall Streeters The tax deal in the Senate would eliminate the tax break used by private equity and hedge fund. Web Carried interest taxation changes proposed in Inflation Reduction Act of 2022.

Web The carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on energy electric. Web Raising taxes on carried interest may give fund managers incentive to employ valuation techniques that minimize or defer the tax or that attempt to recoup income lost as a result. While the committee stopped short of taxing all carried interest as ordinary.

Web August 2 2022. Web Maryland proposes tax on carry management fees. Web WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White.

Web Carried interest is very generally a share of the profits in a partnership paid to its manager. Carried interest has long been the target of lawmaker scrutiny.

Schumer Defends Dropping Carried Interest Tax Change To Win Over Sinema

What Is Carried Interest And How Is It Taxed Tax Policy Center

Carried Interest Tax Proposals What You Need To Know Private Funds Cfo

Summary Of Fy 2022 Tax Proposals By The Biden Administration

/cloudfront-us-east-2.images.arcpublishing.com/reuters/22RXIEMDFFN67MGAUYELV7HTYY.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

How Private Equity Won Its Battle Over Carried Interest Barron S

Tax Reform Series 7 Carried Interest Extended To 3 Year Holding Period Bmf

Carried Interest In Private Equity Calculations Top Examples Accounting

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

What Carried Interest Is And How It Benefits High Income Taxpayers

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It Barron S

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Democrat Tax Hike Proposal Leaves Carried Interest Loophole For Billion Dollar Private Equity Funds Private Equity Models Valuation Tools Made Simple

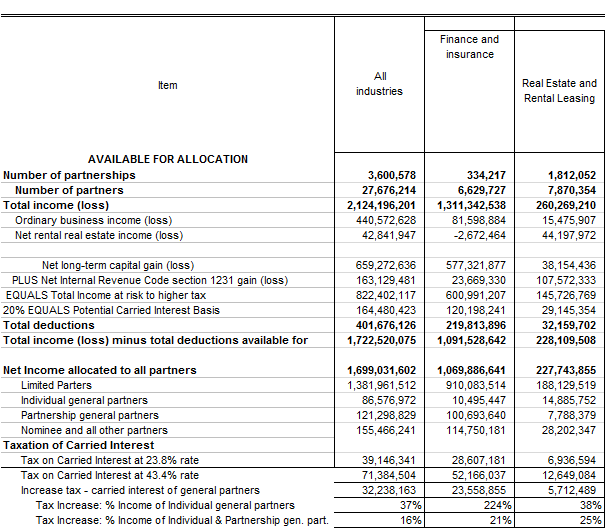

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

The Tax Treatment Of Carried Interest Aaf

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DCYDKFTNRNP3DPHSEWGG4UD2UM.jpg)

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

Manchin Says He Is Firm On Closing Tax Loophole Sinema Absent From Caucus Meeting

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities